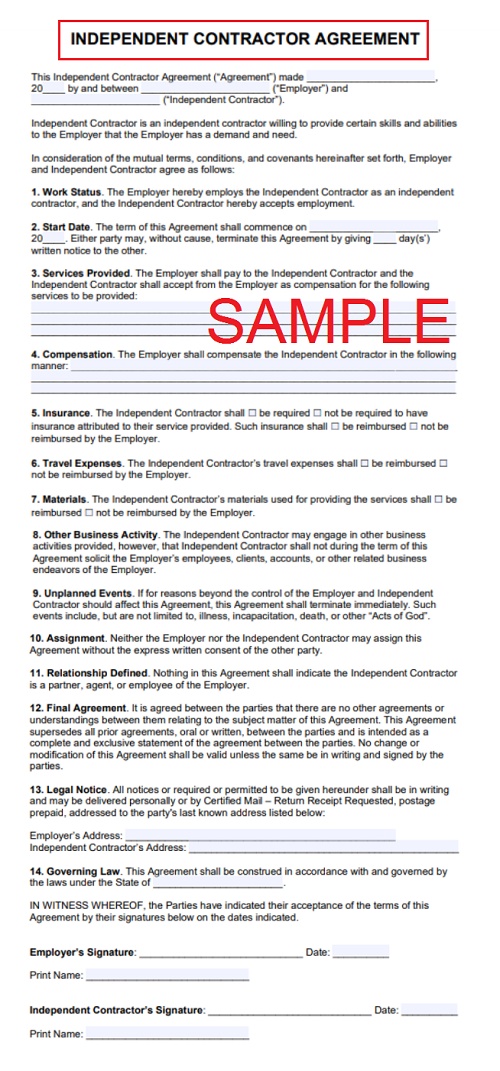

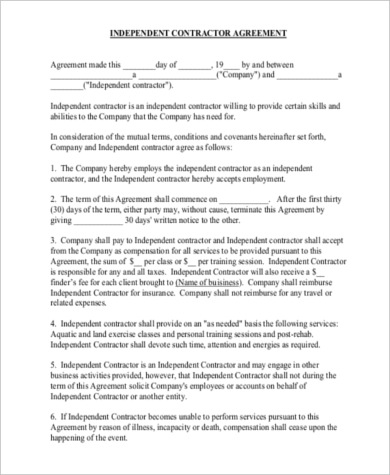

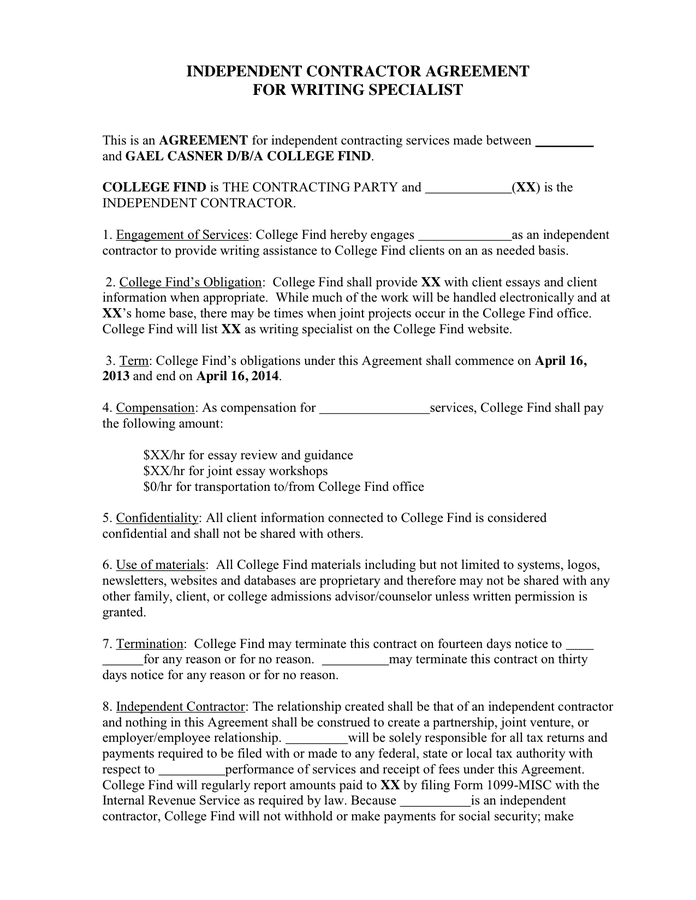

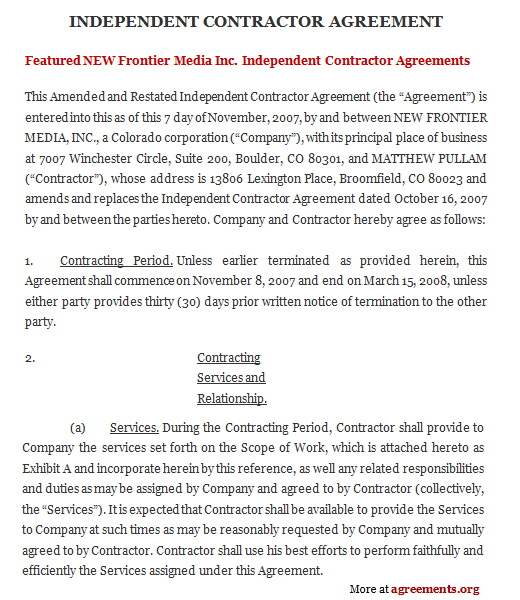

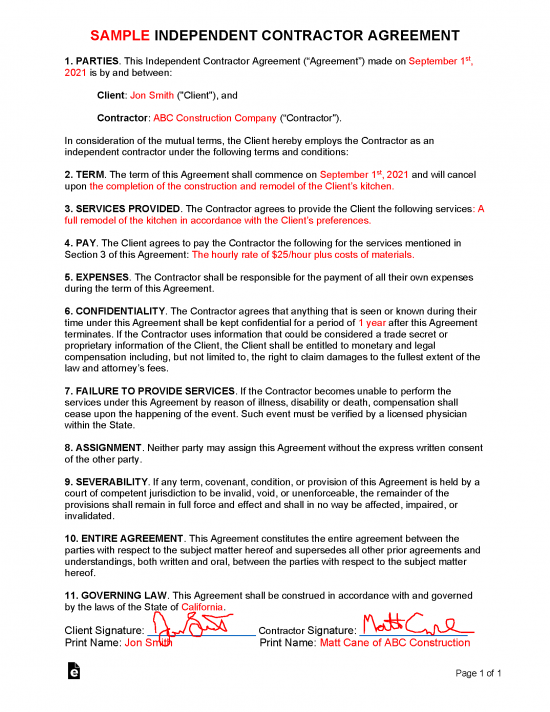

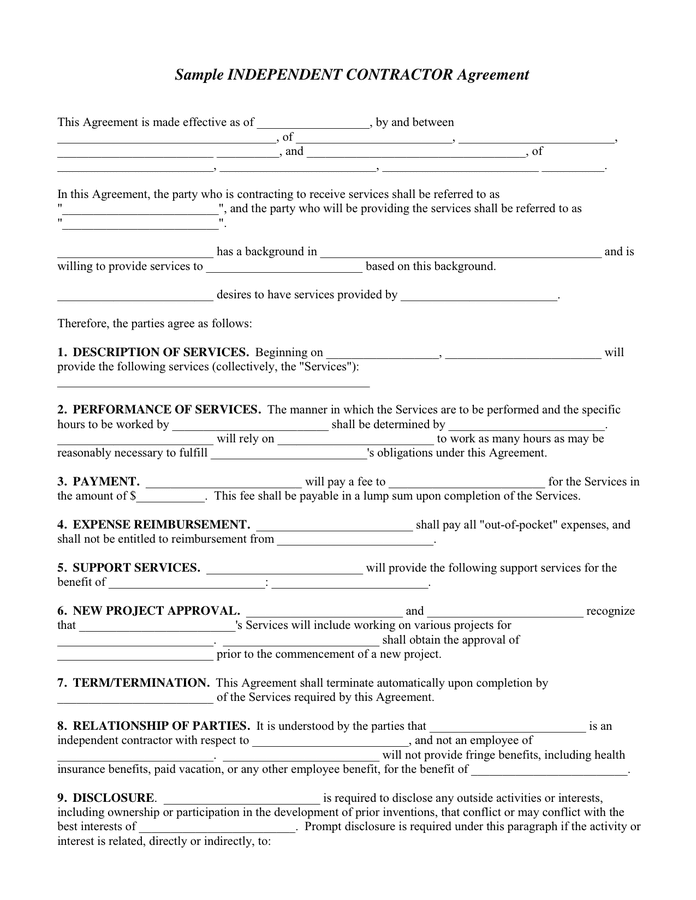

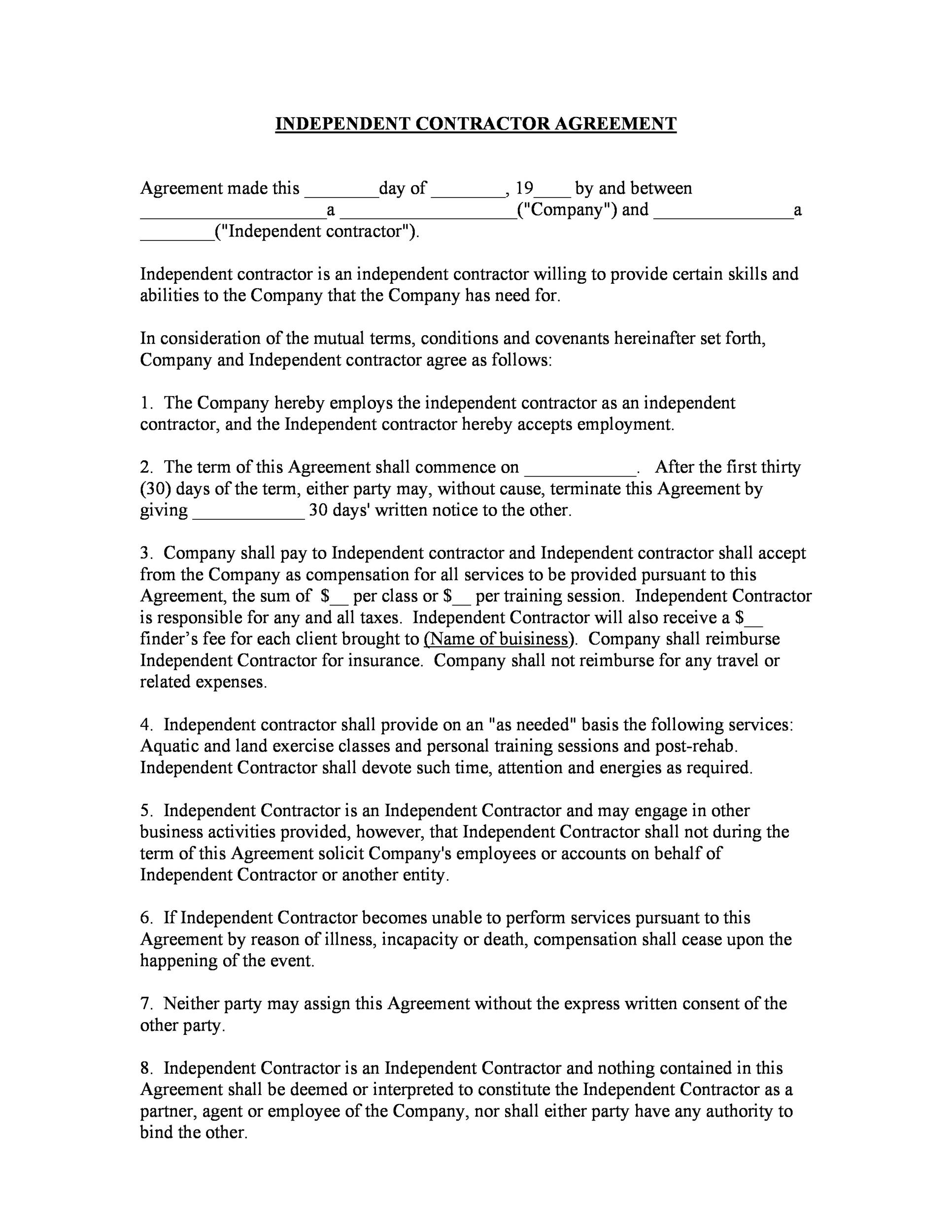

Contractor, and the Independent Contractor hereby accepts employment 2 Start Date The term of this Agreement shall commence on _____, ____ Either party may, without cause, terminate this Agreement by giving ____ day(s') written notice to the other 3 Services Provided The Employer shall pay to the Independent Contractor and theAgreement for salary, vacation, sick leave, workers compensation, insurance, or other employment benefits Contractor alone is responsible for his/her payment of all applicable federal, state and local employment taxes and withholdings, and Company shall file an IRS Form 1099 reflecting all contractual payments paid by CompanyStarting with tax year , the IRS has implemented a new form called the 1099NEC, which covers roughly the same information for contractors that the Form 1099MISC covered in terms of nonemployee compensation Each contractor you pay $600 or more in earnings should receive a 1099NEC form

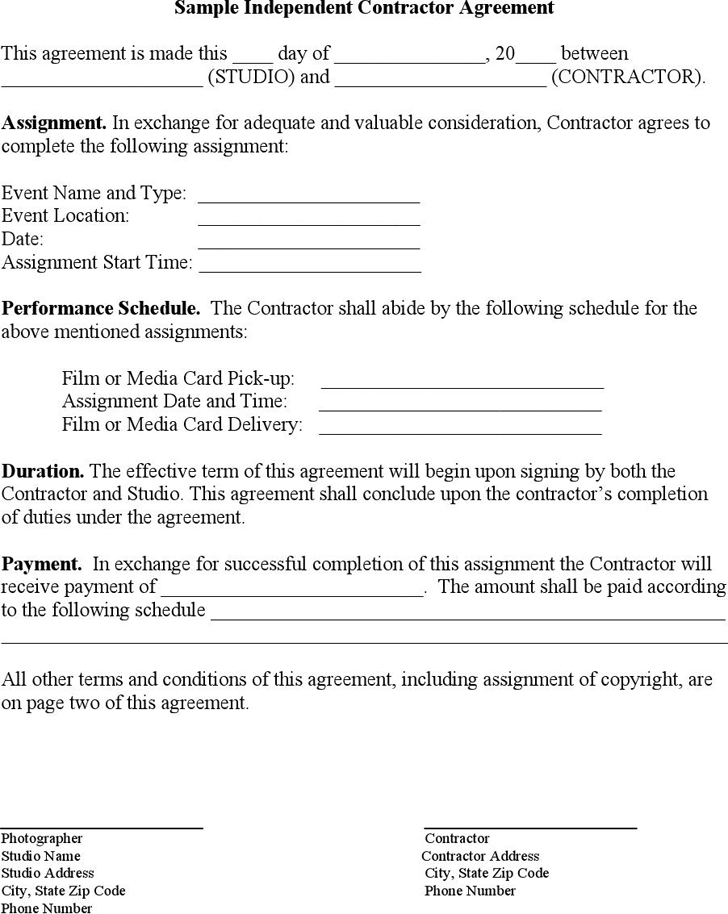

Sample Independent Contractor Agreement In Word And Pdf Formats Page 3 Of 4

Sample independent contractor agreement new york

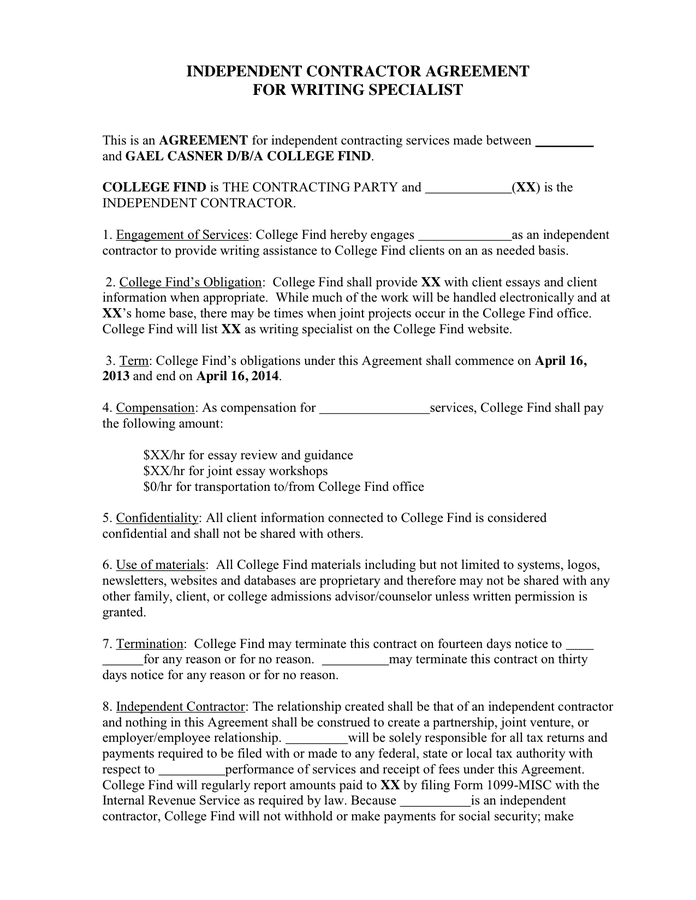

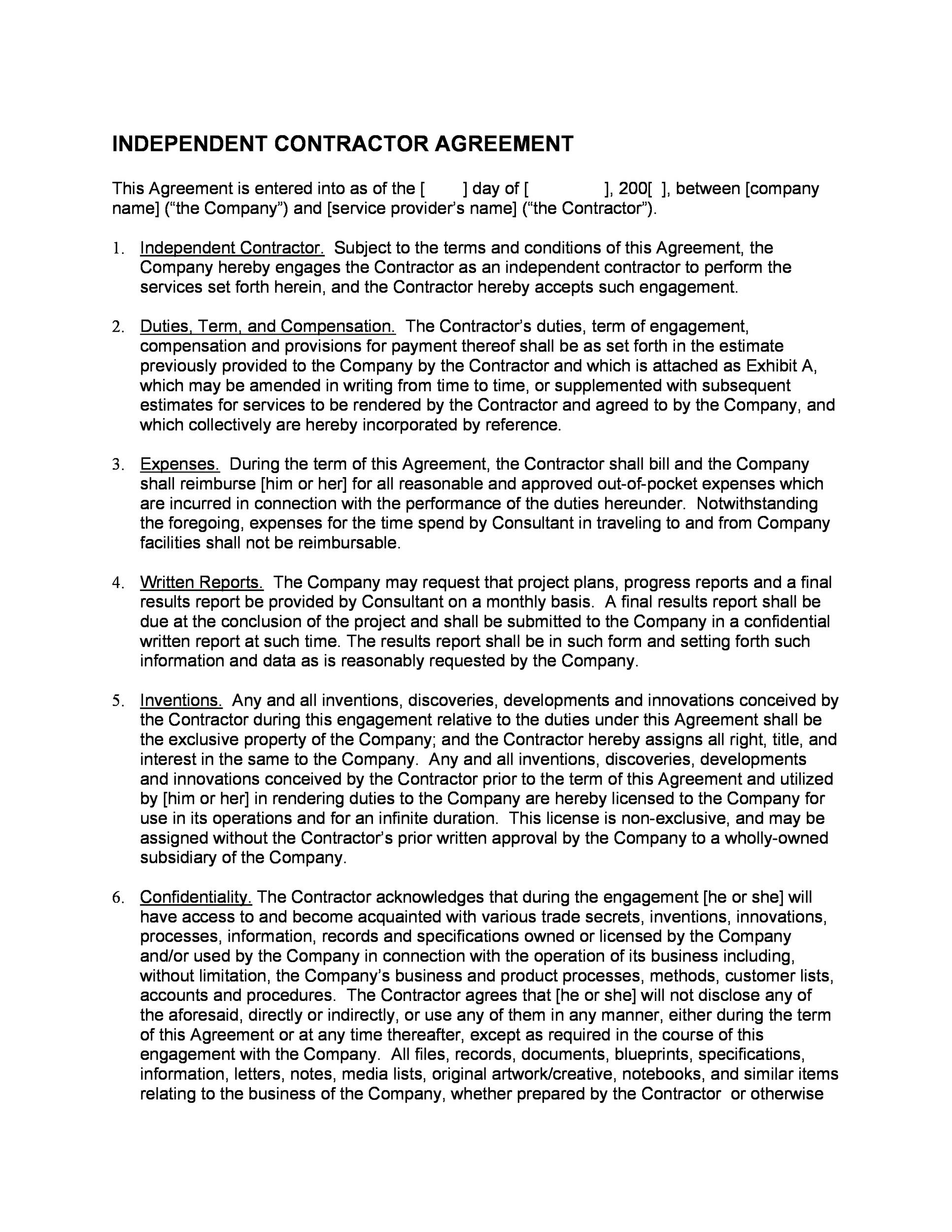

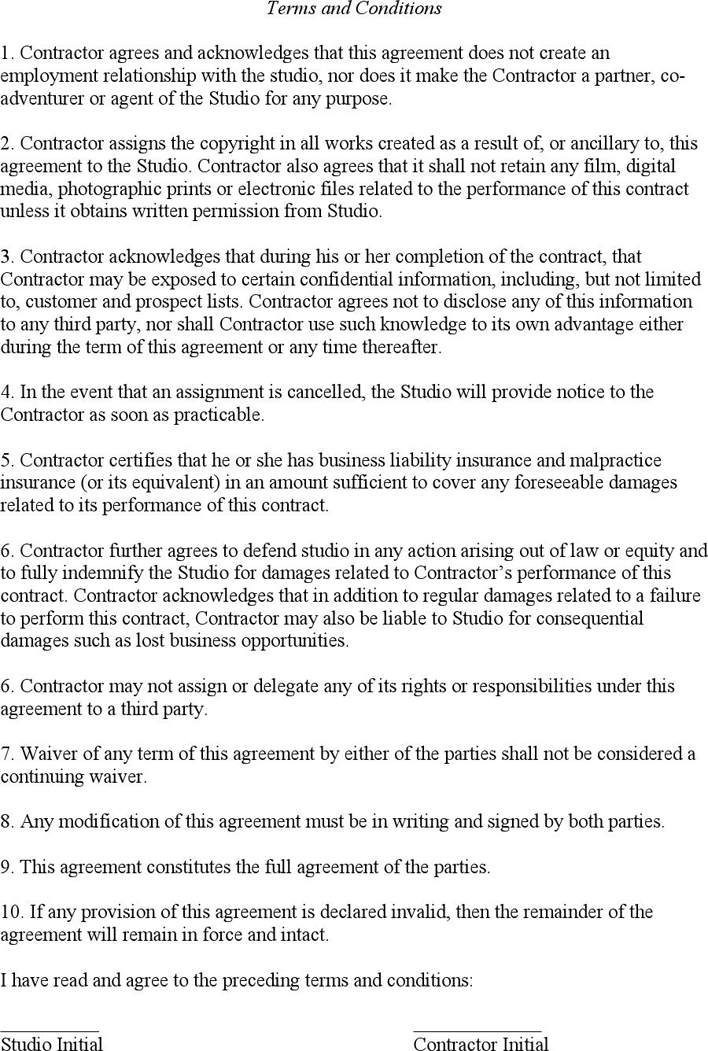

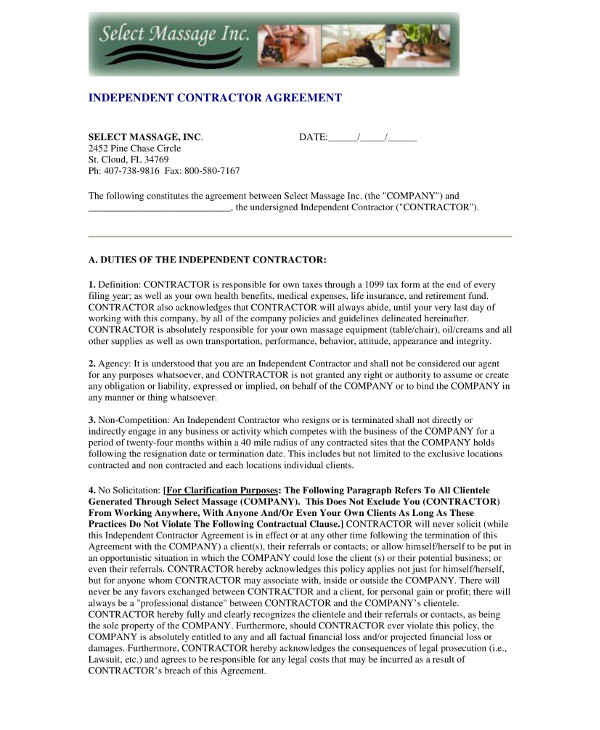

Sample independent contractor agreement new york- Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting themHIPAA Compliance Contractor agrees to respect and abide by all federal, state and local laws pertaining to confidentiality with regard to all information and records obtained or reviewed in the course of providing Services under this Agreement Contractor agrees to adhere to policies and procedures adopted by the Companies and all federal

Independent Contractor Agreement In Word And Pdf Formats

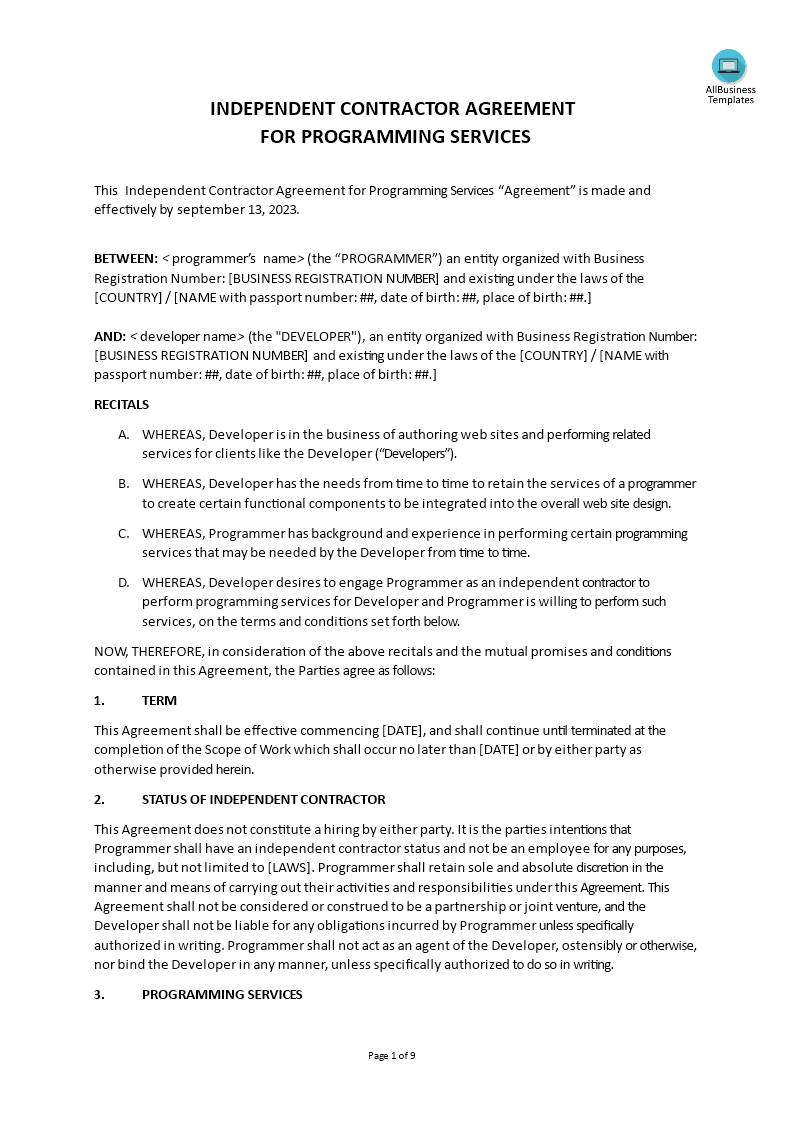

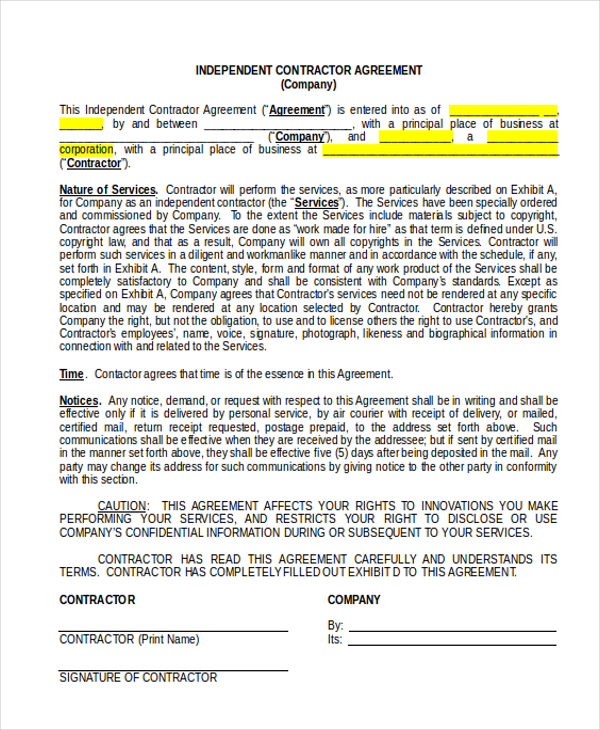

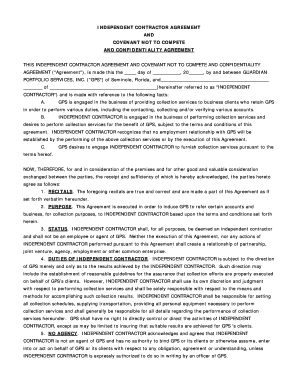

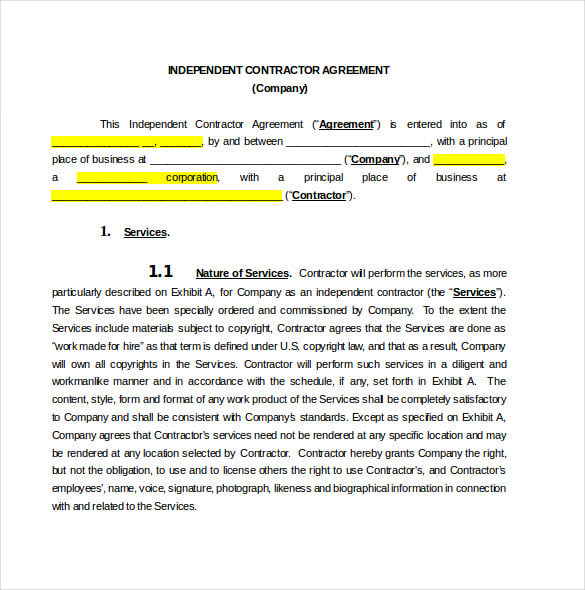

Agreement at the rate provided by Contractor services pursuant to this Agreement II Independent Contractor A Determination of the Manner and Means to Perform the Services; Settlement for Unbiased (IRS Shape 1099) Contracting Products and services _____, known as CONTRACTING PARTY, and _____, known as INDEPENDENT CONTRACTOR, agree Click on right here for PDF model Because the tempo of Executive downsizing continues to extend, terminations for comfort–cancellations of contracts by means of the Executive just because itsYou are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files

Independent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, FICA, or other amounts from its payments to Independent Contractor 9As well as your own health benefits, medical expenses, life insurance, and retirement fund CONTRACTOR also acknowledges that CONTRACTOROrder and Sequence of Work Contractor shall have the sole right and responsibility to determine the manner, method, and means of performance

Contractor shall be paid pursuant to IRS Form 1099, and shall have full responsibility for applicable taxes for all compensation paid to Contractor or its Assistants under this Agreement, and for compliance with all applicable labor and employment requirements with respect to Contractor's selfemployment, sole proprietorship or other form ofDetails Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade 1099 Contractor 50/50 split Same $96,000 1099 gets $48,000 You get $48,000$19,0 (% for expenses) = $28,800 But, your expenses will not go up much, renting her/him space will be the same, so post $28,800 you may only have 10% in expenses

Free Independent Contractor Agreement Free To Print Save Download

Independent Contractor Agreement Programming Templates At Allbusinesstemplates Com

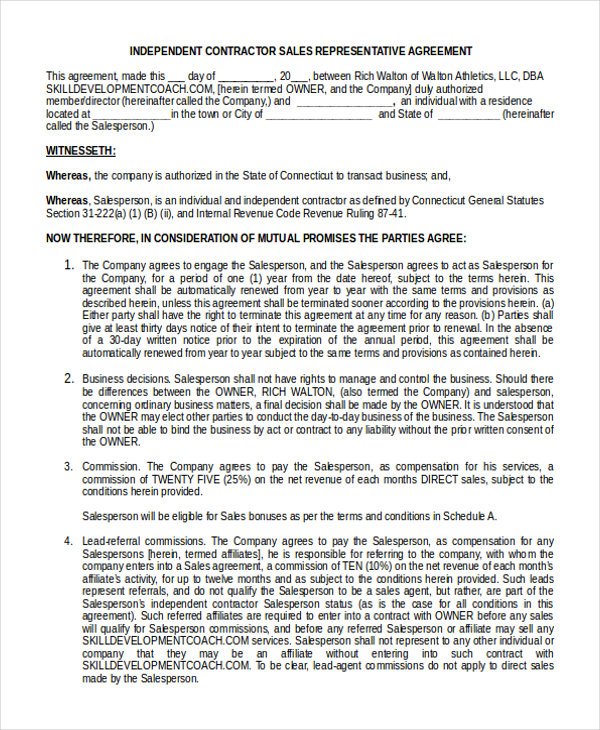

Sample independent contractor agreements are available online Using an independent contractor agreement template will save you time over creating an agreement from scratch The 1099NEC is needed to report how much income an independent contractor earns in a year Because an intelligent question at that point would have been for a lease agreement, not a 1099 employee contract I love it when people say I had an audit and it was okay, so it is legal Majority of all IRS audits already have a target in the office when the audit is started It is what they concentrate onAny customer as a house account, without the Representative's agreement 6 Independent Contractor It is understood that the Representative is an independent contractor, and nothing contained in this Agreement shall be construed as appointing the Representative as an employee of the Company Correspondingly, it is understood that

Independent Contractor Agreement The Association Of Fitness Studios

Independent Contractor Agreement Template Download Printable Pdf Templateroller

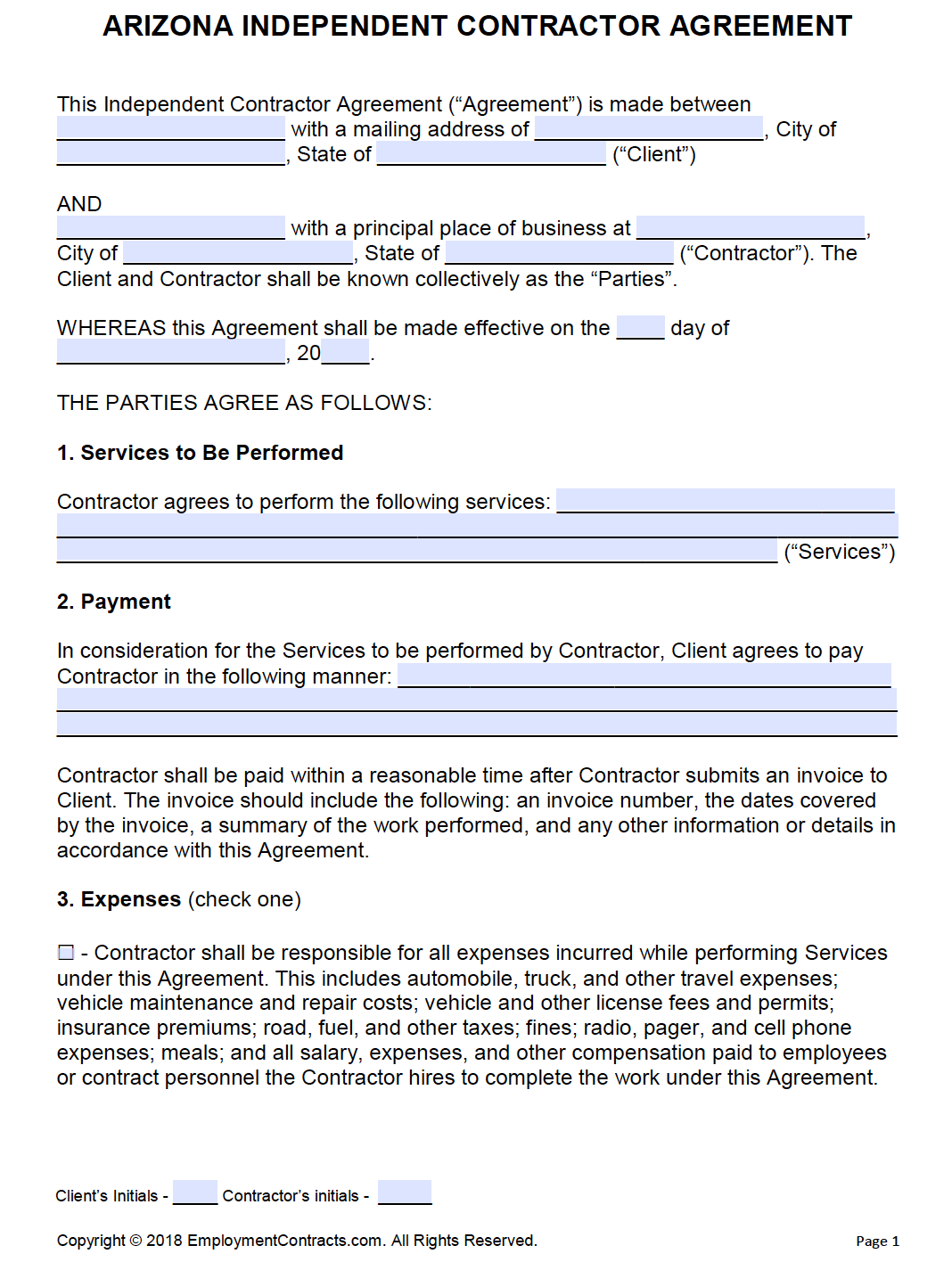

The Compensation Split Agreement Team Splits are compensated as and reported on a 1099 federal income tax form as identified in the above "Relationship" clause Loan Processing All loans are to be processed by a company approved contract processor Originator isCompany and Independent contractor agree as follows 1 The Company hereby employs the independent contractor as an independent contractor, and the Independent contractor hereby accepts employment 2 The term of this Agreement shall commence on _____ After the first thirtyAgreement ☐ Contractor has the sole right to control and direct the means, manner, and method by which the Services required by this Agreement will be performed Contractor shall select the routes taken, starting and quitting times, days of work, and order the work is performed

Exh10 1 Htm

Independent Subcontractor Agreement Template

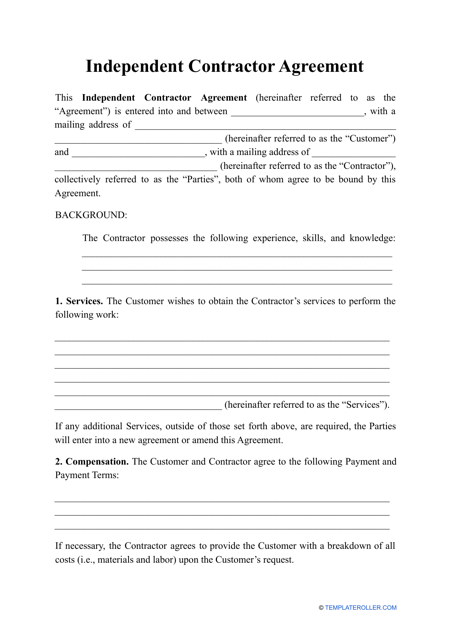

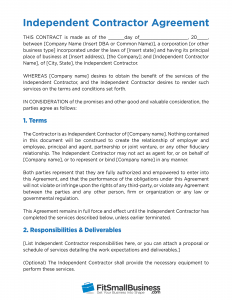

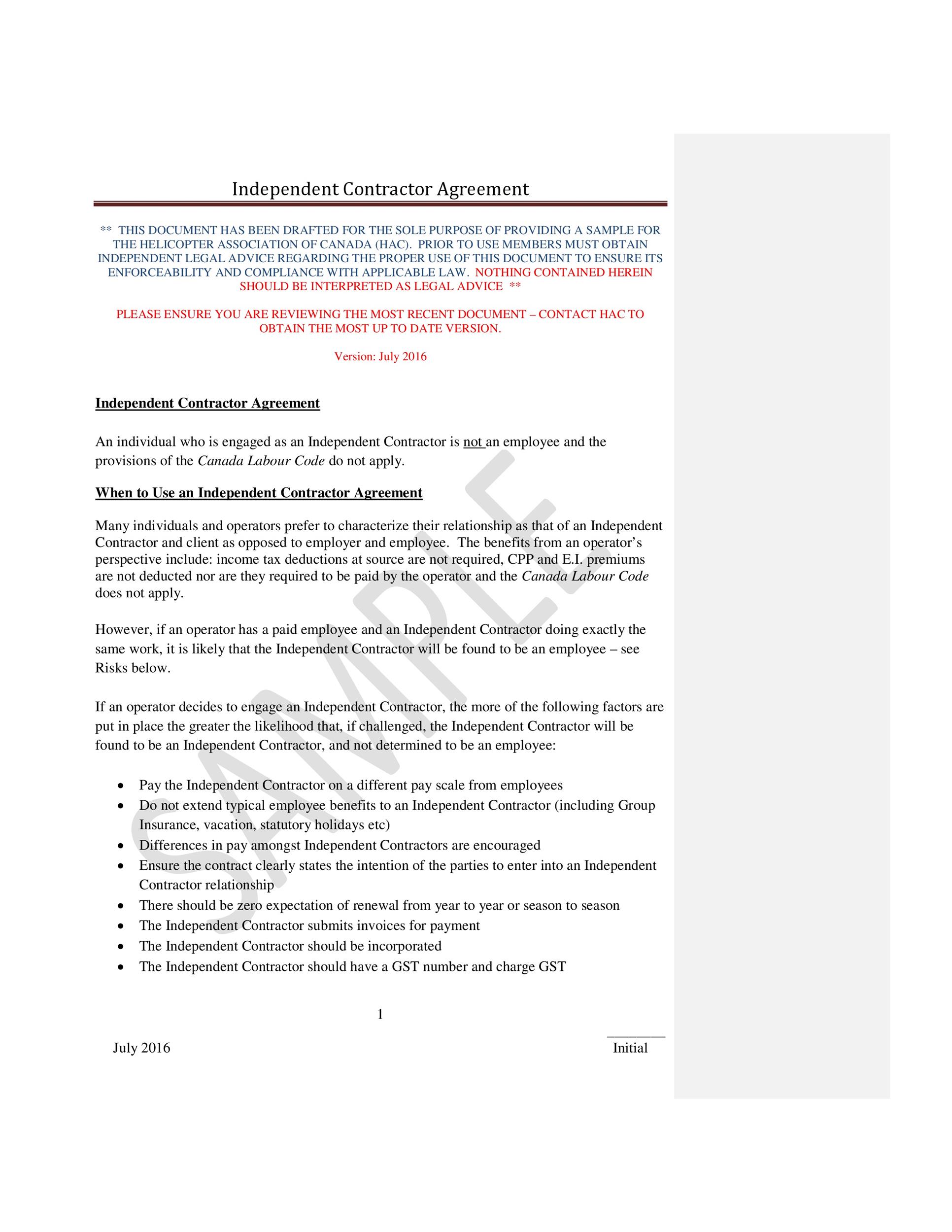

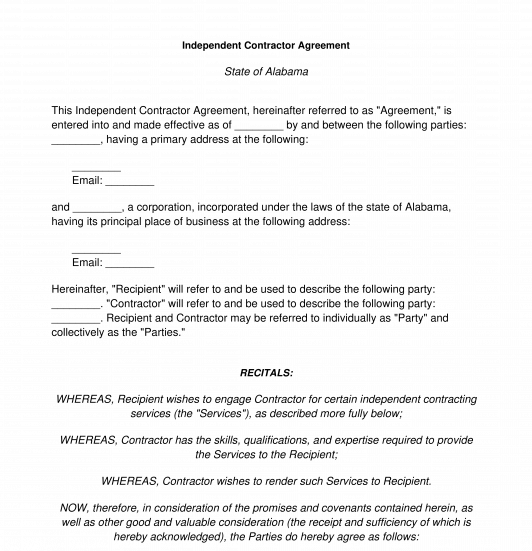

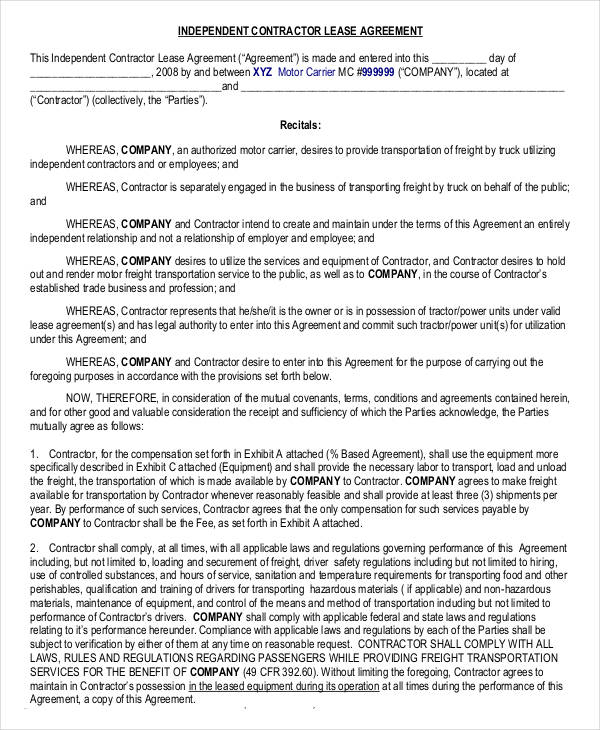

An independent contractor agreement is a contract that documents the terms of a client's arrangement with a contractor This is also referred to as a freelance contract, a general contractor agreement, a subcontractor agreement, and a consulting services agreement, among other alternative namesThis Agreement also may be terminated at any time upon the mutual written agreement of the Company and Contractor 42 Death In the event Contractor dies during the term of this Agreement, this Agreement shall terminate, and the Company shall pay to Contractor's estate the salary which would otherwise be payable to Contractor The Service Agreement, which referred to Ryes as a contract driver, established that Ryes was not an employee of Scout, but the agreement was consistent with Ryes being an independent contractor I have found that can support those that have 1099 contractors Truck Driver was considered an independent contractor and was thus unable to

Www Legalzoom Com Download Pdf Independent Contractor Agreement Pdf

Free 10 Sample Independent Contractor Agreement Forms In Ms Word Pdf Excel

1 Definition CONTRACTOR is responsible for own taxes through a 1099 tax form at the end of every filing year;Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or tradeINDEPENDENT CONTRACTOR AGREEMENT NoticesAll notices hereunder shall be in writing and shall be sent by registered mail or certified mail, return receipt requested, postage prepaid and with receipt acknowledged, or by hand (to an officer if the party to be served is a corporation), or by facsimile or by email, all charges prepaid, at the respective addresses set forth below

An Overview Of A Simple Independent Contractor Agreement I Am Landlord

Independent Contractor Agreement Template Free Pdf Sample Formswift

Spreadsheet or 1099 Excel Template Spreadsheets are a great way to track both your income and your expenses as an independent contractor To get started, create four columns They should be labeled item, cost, date, and then receipt You can make notes about where the receipt is located (maybe an email folder or a physical file)3 Length of Term This Agreement will begin on the Effective Date and end_____ , subject to the following _____ 4 Contractor's Representations and Warranties Contractor represents and warrants to Ministry that a Contractor has the skill, experience, and qualifications to perform the Services, and shall perform the Services in a free independent contractor agreement template & what to avoid an independent contractor agreement is a legal document between a business and an independent contractor that outlines the details of the work to be performed terms of the agreement deliverables pensation and any additional clauses free template and instructions provided free independent contractor agreement

Free Independent Contractor Agreement Template What To Avoid

Free 7 Sample Independent Contractor Agreement Forms In Pdf Ms Word

Size 86 KB Download Prior to taking up a particular task or service, a contractor safety agreement form also needs to be defined with accurate information so that in the case of any injury or mishap, the contractor and the company can face and act in theAn Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including A description of the services provided Terms and length of the project or service Payment details (including deposits, retainers, and other billing details)Client will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees

50 Free Independent Contractor Agreement Forms Templates

Free Printable Independent Contractor Agreement Form Contractor Contract Construction Contract Contract Template

Professional Services Agreement For 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafterPayer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations,Immediately upon entering into this Agreement, Independent Contractor agrees to provide the Company with a completed and signed Form W9, Request for Taxpayer Identification Number and Certification Company will report all income to Independent Contractor on IRS Form 1099

Logo Your Compliance Edge Toggle Navigation Employee Benefits Benefits Notices Calendar Benefits Notices By Company Size Cafeteria Plans Cobra Dental Insurance Dol Audits Educational Assistance Employee Assistance Programs Eaps Erisa

Free Washington Independent Contractor Agreement Word Pdf Eforms

The agreement needs to make it clear that the independent contractor will be a 1099 employee, meaning that the contractor will receive a 1099 form and be responsible for payment of taxes on his or her own The contractor will need to figure theseThe independent contractor nondisclosure agreement is intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state laws That is, if you disclose a trade secret to a contractor without a nondisclosure agreementSample Contractor Safety Agreement Form ehswfuedu Details File Format PDF;

Independent Contractor Agreement Template Easy Legal Templates

Independent Contractor Agreement Bestdox

1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Contractor Agreement, which are incorporated herein by reference DESCRIPTION OF SERVICES AND PROJECT MILESTONES The Services to be performed by Contractor are as followsSLS SAMPLE DOCUMENT 06/21/18 Independent Contractor Agreement Note This document does not reflect or constitute legal advice This is a sample made available by the Organizations and Transactions Clinic at Stanford Law School on the basis set out at nonprofitdocumentslawstanfordedu Your use of this document does not create an attorneyAn Independent Contractor Agreement, also known as a consulting agreement or freelance contract Describes the services being provided or project to be completed Outlines payment details and the length, or term of the contract

Free Independent Contractor Agreement Templates Pdf Word Eforms

Sample Independent Contractor Agreement In Word And Pdf Formats Page 3 Of 4

7 Payment During the term of this Agreement, the Client shall pay the Accountant for the monthly service fees under this Agreement by the 15th of each month, for the previous month's services Additional hours, sales/use tax preparation, and postage, will beThe contract signed between a contractor and their client is known as an Independent Contractor Agreement This legal document is designed to outline the core elements of the transaction between the hiring client and the contractor An Independent Contractor Agreement can also be known as a Freelance Contract Consulting AgreementIf required by the Contractor, a Performance Bond and a Payment Bond in a form satisfactory to the Contractor shall be furnished in the full amount of this Agreement These bonds will be furnished by an insurance company on the list of Acceptable Sureties by the Department of the Treasury within the limits stated thereon 9 CHANGE ORDERS

50 Free Independent Contractor Agreement Forms Templates

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Payers use Form 1099MISC, Miscellaneous Income or Form 1099NEC, Nonemployee Compensation to Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600An independent contractor agreement is between a client and a company that makes a promise to produce services in exchange for paymentThe client will have no responsibility for employees, subcontractors, or personnel in connection with the services provided Their only obligation will be to pay the independent contractor with no liability if anyone should get injured during theINDEPENDENT CONTRACTOR AGREEMENT SALES AGENT This Agreement entered into on the ____ day of _____, ___, between Doctor Backup, LLC (hereinafter referred to as "the Company") and _____ (hereinafter referred to as "the Agent") shall remain in effect from this date until terminated by either party

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Free Independent Contractor Agreement Template For 21 Bonsai

An independent contractor may need to file a 1099MISC form with the IRS to report freelance earnings A company employing independent contractors, will need to complete a 1099MISC form if payments to individual contractors reach a threshold set by the IRSYou are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files This needs to be done for every independent contractor to whom you've paid at least $600 for services, and can be done easily with a Form 1099MISC builder Sample Independent Contractor Agreement Use the independent contractor agreement template below to hire freelancers for your business

Independent Contractor Agreement Sample In Word And Pdf Formats

50 Free Independent Contractor Agreement Forms Templates

A business owner needs an Independent Contractor Agreement for several reasons Setting Expectations An Independent Contractor Agreement explicitly sets out the expectations and parameters of the work to be done, the compensation, and the nature of the relationship itselfIt is a clearcut explanation of the expected workflow, how communication will be handled, and howUnderstanding independent contractor agreement A written contract between two parties, an independent contractor agreement is used for a specific service or projectTo complete a task or project, one company hires another company for a short period using an independent contractor agreement

Independent Contractor Agreement Template Approveme Free Contract Templates

Independent Contractor Agreement For Programming Services Template By Business In A Box

Independent Contractor Agreement This Independent

Free Independent Contractor Agreement Pdf Word

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Free Sample Independent Contractor Agreement Pdf 11kb 2 Page S Page 2

Free Independent Contractor Agreement Templates Word Pdf

Free Sample Independent Contractor Agreement Download Wise

Independent Contractor Agreement In Word And Pdf Formats

50 Free Independent Contractor Agreement Forms Templates

Protect Your Business With An Independent Contractor Agreement Legalzoom Com

Independent Contractor Agreement Sample Template

Independent Contractor Agreement Template My Word Templates

Unique Independent Contractor Agreement California Models Form Ideas

34 Printable Sample Independent Contractor Agreement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Create An Independent Contractor Agreement Download Print Pdf Word

Independent Contractor Agreement For Programming Services Template Sample Best Word Pdf Download

Independent Contractor Agreement Download Pdf Word Agreements Org

17 Printable Independent Contractor Agreement California Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Independent Contractor Agreement Form 53 Simple Joint Venture Agreement Templates Pdf Doc A Templatelab Answer A Few Simple Questions

Free Arizona Independent Contractor Agreement Pdf Word

Free 8 Sample Independent Agreement Contracts In Ms Word Pdf

Independent Contractor Agreement 16 Free Pdf Google Docs Apple Pages Format Free Premium Templates

T0iop8gnzmtpam

Independent Contractor Agreement Pdf Templates Jotform

3

Contractor Agreement Template 23 Free Word Pdf Apple Pages Document Download Free Premium Templates

Sample Independent Contractor Agreement In Word And Pdf Formats

Sample Independent Contractor Agreement

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Free 22 Sample Independent Contractor Agreement Templates In Google Docs Ms Word Apple Pages Pdf

Free 8 Sample Contractor Contract Forms In Pdf Ms Word

Contractor Agreement Template Danetteforda

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

50 Free Independent Contractor Agreement Forms Templates

Self Employed Independent Contractor Agreement With Sales Representative Template Download From Accounting And Finance Agreements

34 Printable Sample Independent Contractor Agreement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Independent Contractor Agreement Sample Tennessee In Word And Pdf Formats

50 Free Independent Contractor Agreement Forms Templates

Www Brotherhoodmutual Com Resources Safety Library Risk Management Forms Independent Contractor Sample Agreement

Free Hair Salon Independent Contractor Agreement Templates Word Pdf

3

Independent Contractor Agreement Full Time

10 Free Independent Contractor Agreement Templates Printable Samples

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Free Florida Independent Contractor Agreement Pdf Word

Free Contract Between Owner And Contractor

Independent Contractor Agreement Business Taxuni

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

Free 10 Sample Independent Contractor Agreement Templates In Ms Word Pdf Google Docs Apple Pages

Free Sample Independent Contractor Agreement Pdf 156kb 15 Page S Page 7

Independent Contractor Agreement Template Word Pdf Download Tracktime24

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Free Independent Contractor Agreement For Download

Sample Consulting Contract

Independent Contractor Commission Agreement Online Business Templates At Allbusinesstemplates Com

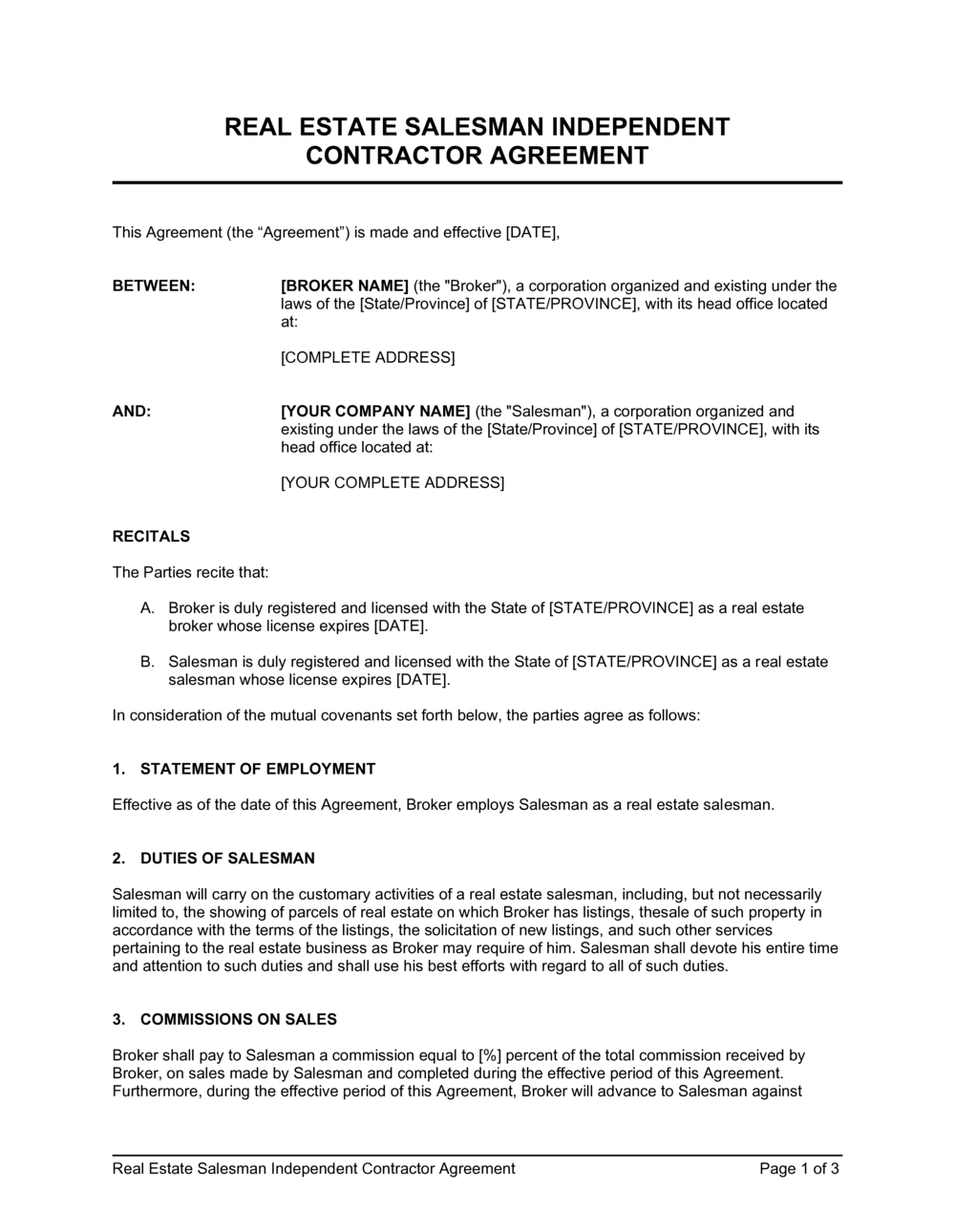

Real Estate Salesman Independent Contractor Agreement Template By Business In A Box

Independent Contractor Contract Template The Contract Shop

Simple Independent Contractor Agreement Form Template

Free Independent Contractor Agreement For Download

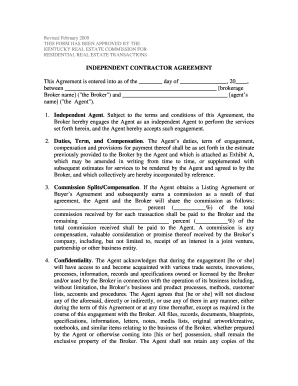

Kentucky Independent Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Use A Nda With Independent Contractor Agreements Everynda

Use A Nda With Independent Contractor Agreements Everynda

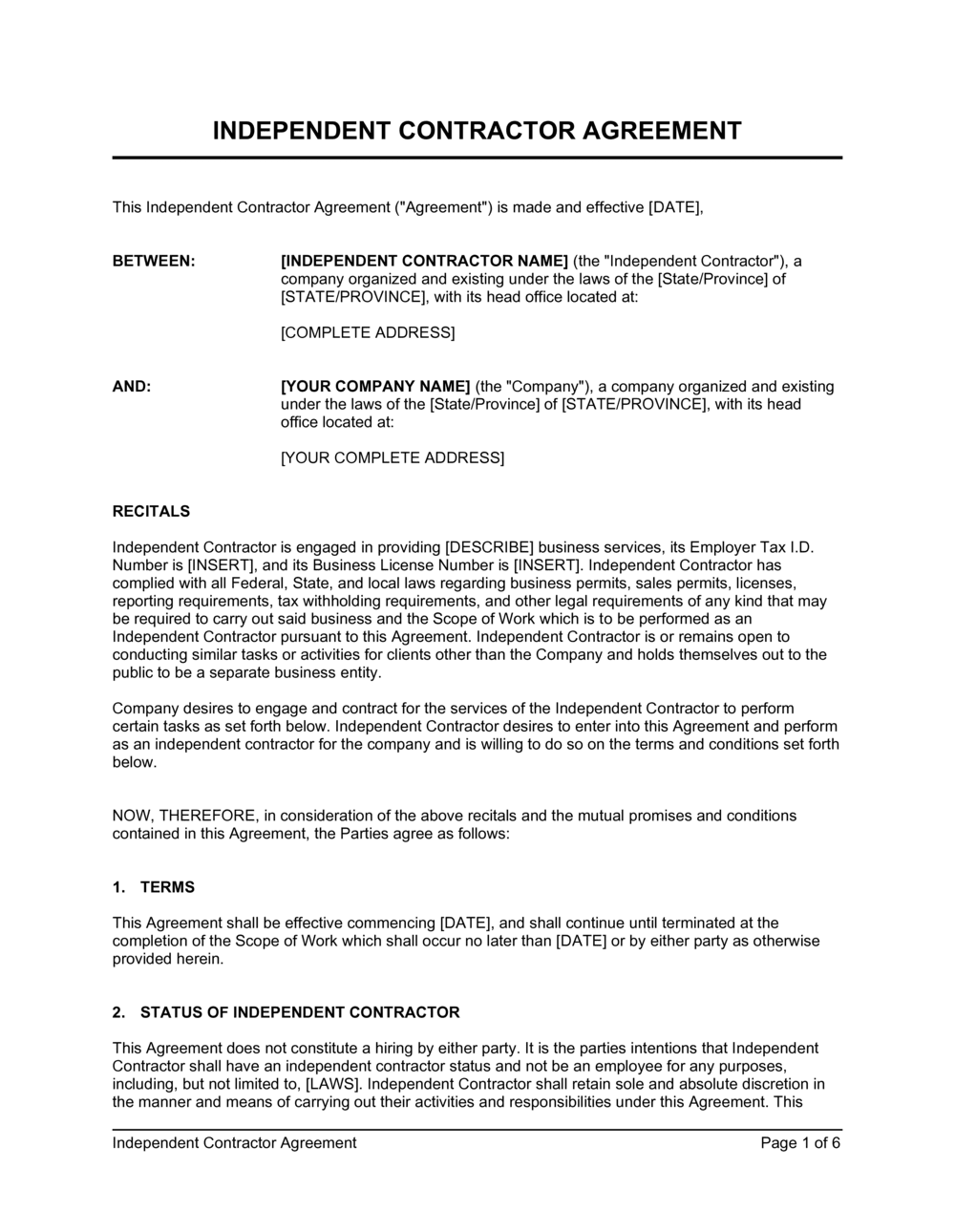

Independent Contractor Agreement Template By Business In A Box

1

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Free Sample Independent Contractor Agreement Pdf 11kb 2 Page S

Independent Contractor Agreement Contractor Agreement Contract Contractor Contract Sample Contractor Contract Contract Contractors

Sample Independent Contractor Non Compete Agreement Word Pdf

3

Free Texas Independent Contractor Agreement Pdf Word

10 Massage Therapy Contract Examples Pdf Word Apple Pages Examples

Independent Contractor Agreement Agreement For Consulting Services

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

50 Free Independent Contractor Agreement Forms Templates